SUBURBAN PROPANE PARTNERS (SPH)·Q1 2026 Earnings Summary

Suburban Propane Q1 FY2026: Net Income Surges 136% on Colder Weather, Strong Volume Growth

February 5, 2026 · by Fintool AI Agent

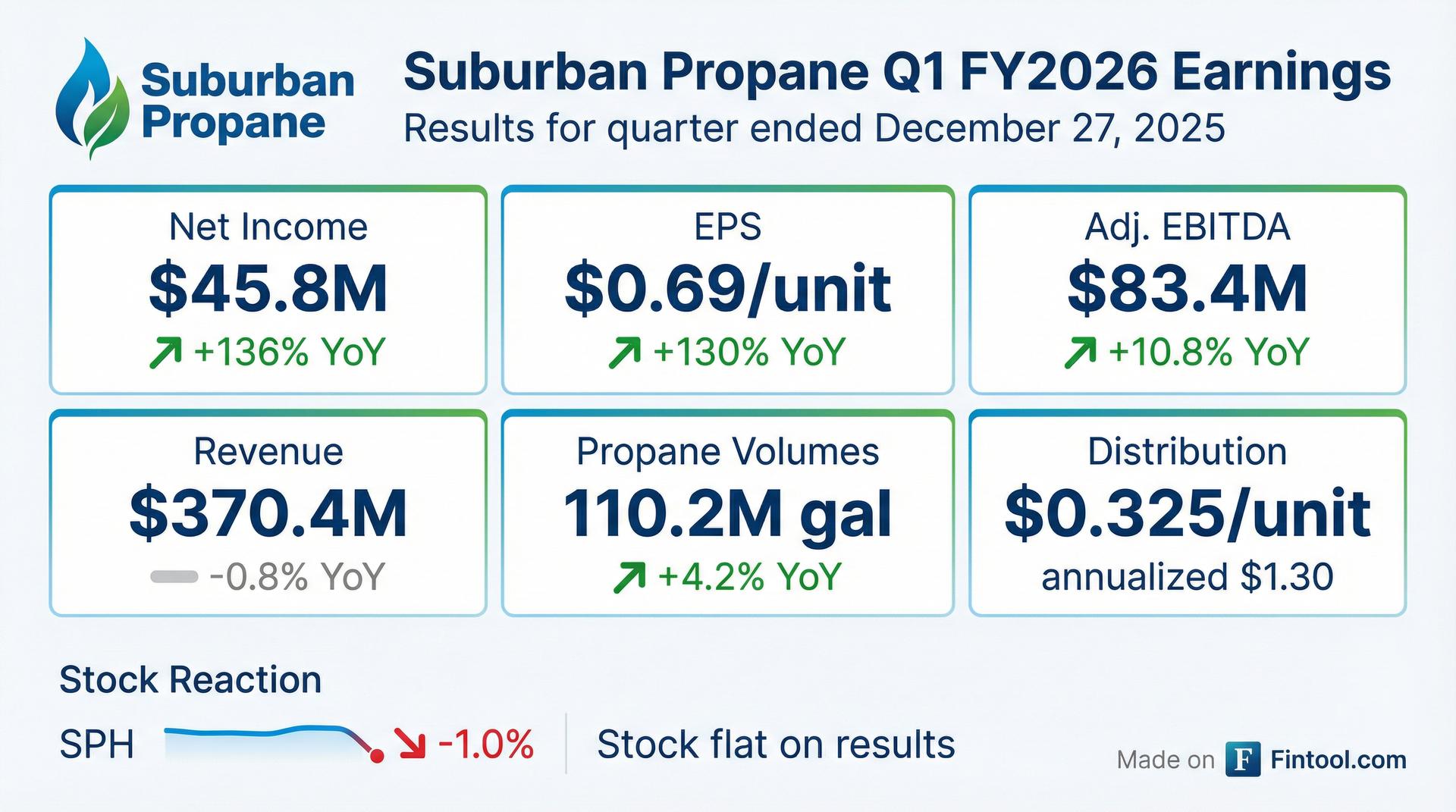

Suburban Propane Partners (NYSE: SPH) reported fiscal Q1 2026 results that demonstrated the leverage in its business model when weather cooperates. Net income more than doubled to $45.8 million ($0.69/unit) from $19.4 million ($0.30/unit) in the prior year, as colder temperatures across the eastern U.S. drove a 4.2% increase in propane volumes and effective pricing lifted unit margins.

Did Suburban Propane Beat Earnings?

The partnership delivered a strong quarter with the key operational metrics showing meaningful improvement:

The divergence between revenue and profitability metrics tells the story: while total revenues dipped slightly due to a 14% decline in propane commodity prices (basis Mont Belvieu), the partnership's retail margins expanded significantly.

What Drove the Volume Growth?

CEO Michael Stivala attributed the strong quarter to favorable weather dynamics and successful customer retention initiatives:

"The fiscal 2026 heating season is off to a solid start, driven by cooler average temperatures in the Northeast, Mid-Atlantic and Midwest regions of our operating footprint, along with continued positive trends in our customer base growth and retention initiatives."

Weather Impact by Region:

- East: Temperatures in line with normal, 12% cooler than prior year Q1

- West: 24% warmer than normal, 11% warmer than prior year

- Overall: 6% warmer than normal but 6% cooler than prior year

The Eastern regions, where the bulk of Suburban's heating demand resides, saw meaningfully cooler weather that more than offset warm conditions in the West.

How Did Margins Expand?

Total gross margin increased $13.4 million (+5.9%) to $239.5 million despite lower revenues. Excluding mark-to-market adjustments, gross margin rose $16.1 million (+7.2%).

The improvement in unit margins reflects disciplined pricing against a backdrop of lower commodity costs, allowing the partnership to capture more of the spread between wholesale and retail.

How Did the Stock React?

SPH shares traded essentially flat following the earnings release:

- Prior Close (Feb 4): $20.18

- Current: $19.95 (-1.1%)

- 52-Week Range: $17.30 - $22.24

The muted reaction suggests the market may have anticipated improved results given the well-publicized cold weather across the eastern U.S. in recent weeks. With a 6.5% distribution yield at current prices, SPH continues to trade as an income-oriented investment.

What Changed From Last Quarter?

Q4 FY2025 (ended September 2025) represented the seasonal trough for the propane business, with a net loss typical for the off-season. The swing to Q1 profitability reflects normal seasonality, but the year-over-year improvement is notable:

*Values retrieved from S&P Global

The key delta versus prior year Q1 is the weather benefit and margin improvement, not a structural change in the business.

What's Happening With RNG?

Management highlighted progress on renewable natural gas (RNG) initiatives:

"In our renewable natural gas operations, average daily RNG injection for the first quarter improved compared to the prior sequential quarter and prior year first quarter due to an increase in facility uptime and from the operational enhancements implemented at our production facility in Stanfield, Arizona."

RNG Milestones:

- Started commissioning new anaerobic digester facility in Upstate New York (December 2025)

- Made substantial progress on gas upgrade equipment at Columbus, Ohio facility

- RNG capital projects targeting completion toward end of Q2 FY2026, with injection scheduled to begin in H2 FY2026

Capital Allocation Highlights

Acquisitions: Acquired two propane businesses in California for $24.0 million total

Debt Refinancing: In December 2025, refinanced $350 million of 5.875% senior notes due 2027 with new 6.50% senior notes due 2035, extending weighted average debt maturities by nearly three years.

Leverage: Consolidated Leverage Ratio improved to 4.57x (trailing 12 months ended December 27, 2025) from 4.99x in the prior year period.

Distribution: Quarterly distribution of $0.325 per Common Unit ($1.30 annualized), payable February 10, 2026. Distribution coverage remains strong at 2.19x for December 2025.

Working Capital: Borrowed $115.4 million under the revolving credit facility and raised $3.1 million through ATM equity issuance to fund seasonal working capital needs and RNG projects.

Key Risks to Monitor

Management's forward-looking statements highlight several risks:

- Weather Volatility: Demand is highly dependent on heating degree days; warm winters can significantly impact volumes

- Commodity Price Swings: Ability to pass through cost changes to retail customers

- Climate Policy: Potential legislation affecting propane demand

- RNG Execution Risk: Permitting, construction, and operational challenges for renewable fuel projects

- Tariff Uncertainty: Economic volatility from trade policy

Q&A Highlights

Notably, no analysts had questions during the call's Q&A session, suggesting the results were straightforward and in-line with expectations given the well-publicized cold weather this winter.

Management emphasized employee dedication during recent extreme weather:

"Our operations personnel are well prepared and working tirelessly to safely meet customer demand... I want to take a moment to thank them for their exceptional efforts during these sustained cold and extreme weather conditions."

Looking Ahead

With the heating season underway and cold weather sweeping the eastern U.S. in recent weeks, Suburban Propane appears well-positioned for continued strong volumes in Q2 FY2026. The partnership's focus on:

- Customer retention initiatives supporting volume growth

- RNG investments for long-term diversification

- Strategic acquisitions in core propane markets

- Balance sheet improvement with lower leverage and extended maturities

...suggests management is balancing current distribution coverage with investments for future growth.

Data as of February 5, 2026. Financial data sourced from company filings.